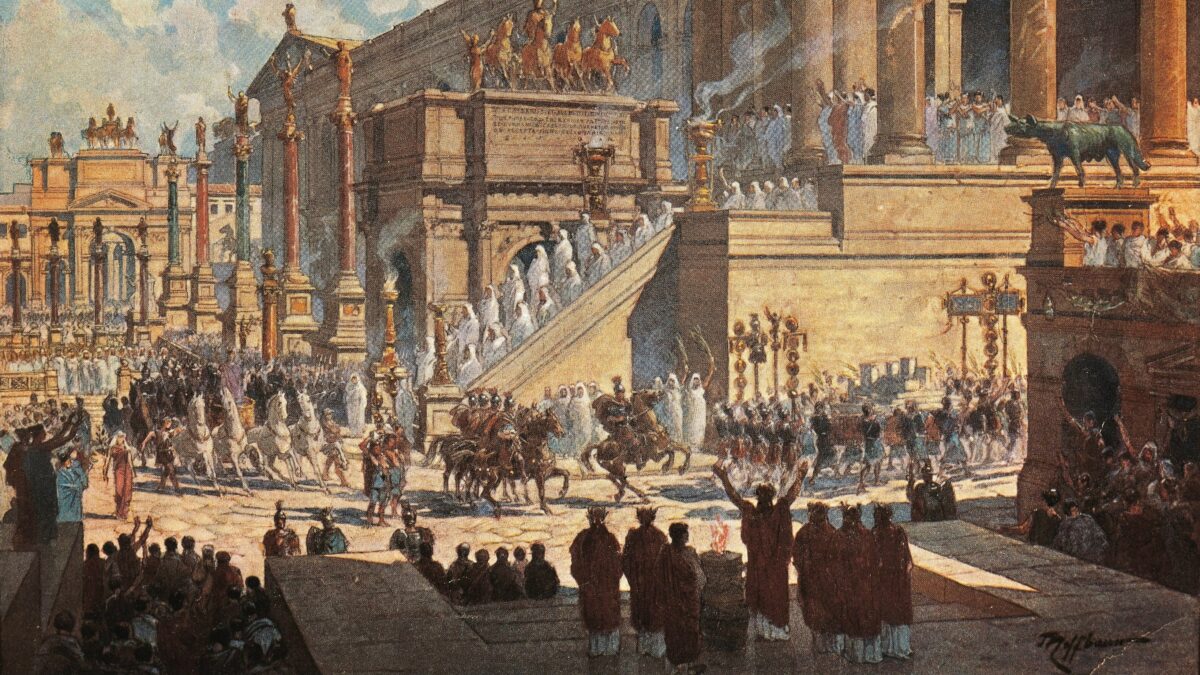

Introdução O Renascimento foi um período de grande importância na história da humanidade, marcado por mudanças significativas nas áreas da arte, ciência, literatura e política. Neste resumo, exploraremos os principais aspectos desse movimento cultural que ocorreu entre os séculos XIV e XVI. Contexto Histórico O Renascimento teve origem na Itália, mais especificamente nas cidades de […]

Resumo do assunto Renascimento