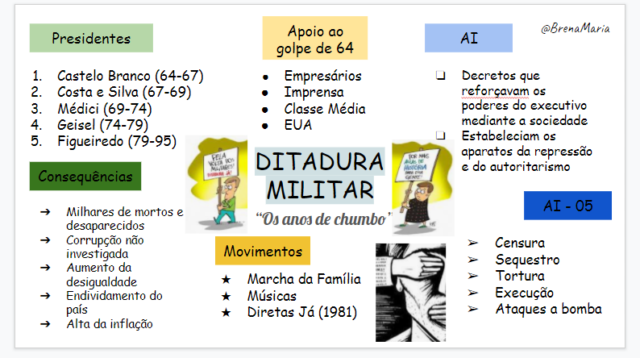

Contexto Histórico e Golpe de 1964 O período ditatorial no Brasil, que se estendeu de 1964 a 1985, teve início com um golpe militar que derrubou o presidente democraticamente eleito João Goulart. O contexto da Guerra Fria e o temor de um avanço comunista na América Latina foram motivadores chave para a ação dos militares, […]